We search the world

for non-traditional investment strategies that meet the “Absolute Return” needs of our institutional investors.

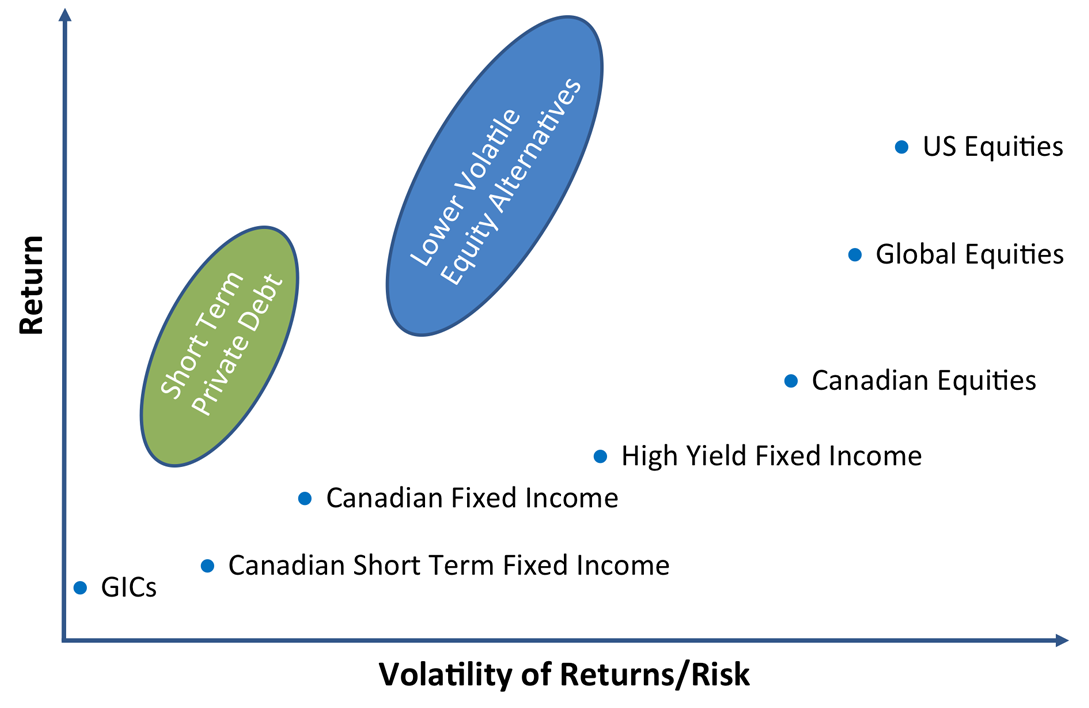

We provide non-traditional fixed income and equity investment strategies that improve institutional investors’ expected risk-adjusted returns.

ASSET CLASS

DESCRIPTION

TARGET RETURN

Real Estate Debt (A Notes)

Absolute Return 4%

Ultra Short-Term Private Debt

Supply Chain Financing

Absolute Return CPI + 4%

Television & Film Production Loans

Absolute Return 7-9%

Canadian Farmland

Absolute Return CPI + 5%

Alternative ESG Long Short Equity

Absolute Return 7-9%

Lower Volatility Equity Alternatives

Co-Invest Direct Real Estate

Absolute Return 5-15%

ESG Infrastructure

Absolute Return 15-20%

Private Equity Secondaries

Absolute Return 18%

Westfield clients have added more than 100 Absolute Return fundings since the beginning of 2021.

- Pension Plans

- Health & Wellness Trusts

- Training & Education Trusts

- Benevolent Trusts

- Trade Improvement Trusts

- Disability Income Plans

- Endowments

- Foundations

- Reserve Accounts

Direct Access

Providing investors with efficient and direct access to our Institutional Investment Partners.

Fees

Westfield Partners is paid by the investment firms. There are no additional fees to investors for WPL involvement.